OUR SERVICES

FROM FINANCIAL CONSULTANCY TO DAILY BOOKKEEPING AND STRATEGY DEVELOPMENT, OUR WIDE-RANGING SERVICES ARE DESIGNED TO SUPPORT THE GROWTH OF YOUR BUSINESS.

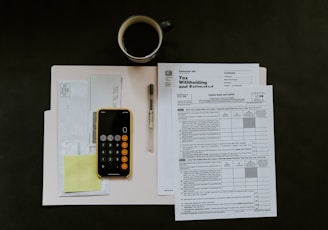

ACCOUNTING & BOOKKEEPING SERVICES

ACCESS THE QUICKEST, MOST DEPENDABLE, AND COST-EFFECTIVE ACCOUNTING AND BOOKKEEPING SERVICES AVAILABLE IN THE USA.

AS BUSINESS INCREASES, YOUR RESPONSIBILITIES CAN QUICKLY MULTIPLY. ARE YOU SPENDING TOO MUCH TIME STRESSED OUT OVER ACCOUNTING AND FINANCES?

SMARTAX ACCOUNTANTS ARE DEDICATED IN ENABLING YOU TO ATTAIN GREATER FREEDOM. OUR OUTSOURCED ACCOUNTING SERVICES LIBERATE YOUR TIME, ALLOWING YOU TO CONCENTRATE ON EXPANDING YOUR BUSINESS. WITH OUR FIXED-RATE ACCOUNTING SERVICES, WE MANAGE ALL ASPECTS OF YOUR DAILY FINANCIAL RECORD-KEEPING, INCLUDING ACCOUNTS PAYABLE, ACCOUNTS RECEIVABLE, AND MONTH-END ACCOUNTING TASKS.

TAXATION SERVICES

NAVIGATING SMALL BUSINESS TAX RETURNS CAN POSE CHALLENGES. IT REQUIRES A THOROUGH UNDERSTANDING OF ELIGIBLE DEDUCTIONS, CREDITS, AND STRATEGIES, WHICH DEMANDS BOTH PATIENCE AND EXPERTISE. HAVE YOU CONSIDERED WHETHER YOU MIGHT BE PAYING MORE TAXES THAN NECESSARY?

GET EXPERT TAX PREPARATION SERVICES TO ENSURE SMALL BUSINESS SUCCESS. OUR OFFERINGS INCLUDE BOTH ONSITE AND CLOUD-BASED SERVICES TAILORED TO MEET YOUR SPECIFIC NEEDS AND PREFERENCES.

BENEFITS FOR HAVING A TAX ACCOUNTANT:

- A QUALIFIED TAX ACCOUNTANT POSSESSES IN-DEPTH KNOWLEDGE AND EXPERTISE IN TAX LAWS AND REGULATIONS, ENSURING ACCURATE AND COMPLIANT TAX FILINGS. THEY CAN HELP IDENTIFY ELIGIBLE DEDUCTIONS, CREDITS, AND TAX-SAVING STRATEGIES, MINIMIZING YOUR TAX LIABILITY AND MAXIMIZING YOUR RETURNS.

- WORKING WITH A TAX ACCOUNTANT SAVES YOU TIME AND RELIEVES THE STRESS OF NAVIGATING COMPLEX TAX PROCEDURES AND DEADLINES. THIS ALLOWS YOU TO FOCUS ON CORE BUSINESS ACTIVITIES AND STRATEGIC INITIATIVES, ULTIMATELY DRIVING GROWTH AND SUCCESS FOR YOUR SMALL BUSINESS.

- TAX ACCOUNTANT CAN PROVIDE VALUABLE INSIGHTS AND ADVICE ON FINANCIAL MATTERS, SUCH AS BUDGETING, CASH FLOW MANAGEMENT, AND STRATEGIC PLANNING.

UNCERTAIN ABOUT WHERE TO BEGIN?

TAKE ADVANTAGE OF OUR QUICKBOOKS REVIEW, OFFERING A PROMPT AND COST-EFFECTIVE ASSESSMENT OF YOUR FINANCIAL HEALTH. GAIN ACCESS TO RELIABLE, EXPERT ADVICE WITHOUT ANY FURTHER OBLIGATIONS.

QUICKBOOKS REVIEW

AS YOUR BUSINESS EXPANDS, MANAGING THE NUMBERS BECOMES INCREASINGLY INTRICATE. ARE YOUR BOOKKEEPING AND ACCOUNTING METHODS ADAPTING ACCORDINGLY?

QUICKBOOKS REVIEW OFFERS A STRAIGHTFORWARD AND COST-EFFECTIVE OPTION FOR SMALL BUSINESSES THAT MIGHT NOT BE PREPARED TO DELEGATE ACCOUNTING TASKS BUT SEEK EXPERT ADVICE TO MAINTAIN ACCURACY. WE WILL ASSESS YOUR ACCOUNTS, TRANSACTIONS, AND CURRENT QUICKBOOKS CONFIGURATION, PROVIDING RECOMMENDATIONS FOR ENHANCEMENT IN AREAS WITH ERRORS OR INCORRECT UTILIZATION. ADDITIONALLY, WE CAN PINPOINT OPPORTUNITIES WHERE YOU MIGHT NOT BE MAXIMIZING THE POTENTIAL OF QUICKBOOKS SOFTWARE.

BENEFITS YOUR BUSINESS CAN DERIVE FROM THIS?

ENHANCED PRODUCTIVITY: WE EVALUATE YOUR EXISTING BOOKKEEPING WORKFLOW AND PINPOINT AREAS FOR TARGETED ENHANCEMENTS, FACILITATING QUICKER AND MORE INTELLIGENT SMALL BUSINESS ACCOUNTING.

STREAMLINED SOFTWARE UTILIZATION: OUR TEAM OFFERS ADVICE ON TAILORING YOUR QUICKBOOKS REPORTS AND FORMS, ADJUSTING PREFERENCES, AND INTEGRATING CRUCIAL FEATURES TO ENHANCE TRACKING CAPABILITIES.

COST-EFFECTIVE SOLUTIONS: OUR QUICKBOOKS REVIEW SERVICE CAN LEAD TO SIGNIFICANT TIME AND COST SAVINGS BY ENSURING THAT YOUR SOFTWARE AND PROCESSES ARE ALIGNED WITH YOUR BUSINESS OBJECTIVES AND OPERATIONAL NEEDS.